These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings. In the next accounting period, these temporary accounts are opened again and normally start with a zero balance. In a general financial accounting system, temporary or nominal accounts include revenue, expense, dividend, and income summary accounts.

Permanent Accounts

On the balance sheet, $75 of cash held today is still valued at $75 next year, even if it is not spent. In order to produce more timely information some businesses issue financial statements for periods shorter than a full fiscal or calendar year. Such periods are referred to as interim periods and the accounts produced as interim financial statements.

How to Prepare Your Closing Entries

In other words, it contains net income or the earnings figure that remains after subtracting all business expenses, depreciation, debt service expense, and taxes. The income summary account doesn’t factor in when preparing financial closing entries statements because its only purpose is to be used during the closing process. Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero.

Get in Touch With a Financial Advisor

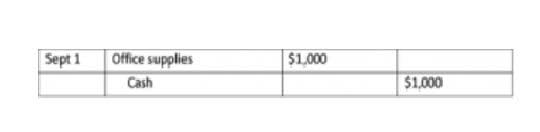

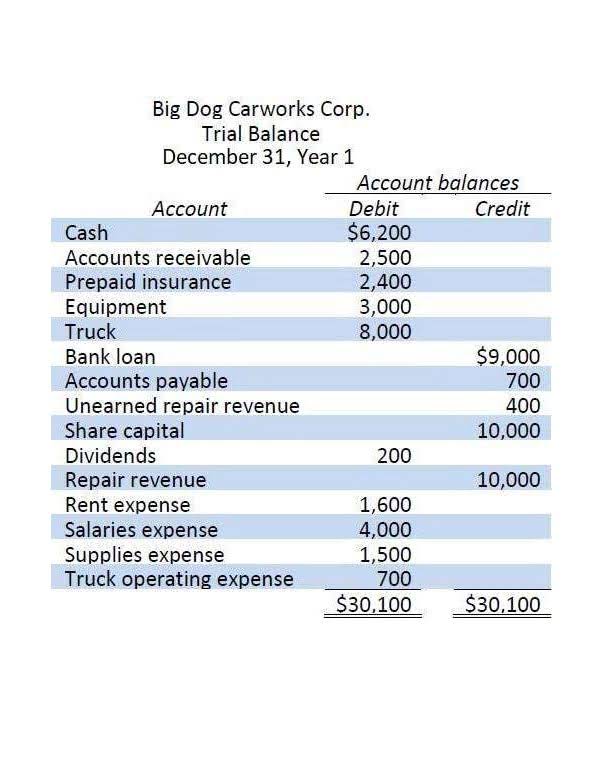

However, you might wonder, where are the revenue, expense, and dividend accounts? These accounts were reset to zero at the end of the previous year to start afresh. On expanding the view of the opening trial balance snapshot, we can view them as temporary accounts, as can be seen in the snapshot below. Closing your accounting books consists of making closing entries to transfer temporary account balances into the business’ permanent accounts. The first entry requires revenue accounts close to the Income Summary account. To get a zero balance in a revenue account, the entry will show a debit to revenues and a credit to Income Summary.

- For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C).

- The post-closing T-accounts will be transferred to the post-closing trial balance, which is step 9 in the accounting cycle.

- The remaining balance in Retained Earnings is $4,565 (Figure 5.6).

- Thus, the income summary temporarily holds only revenue and expense balances.

- What are your total expenses for rent, electricity, cable and internet, gas, and food for the current year?

To make them zero we want to decrease the balance or do the opposite. We will debit the revenue accounts and credit the Income Summary account. The credit to income summary should equal the total revenue from the income statement. Notice that the effect of this closing journal entry is to credit the retained earnings account with the amount of 1,400 representing the net income (revenue – expenses) of the business for the accounting period. Notice that revenues, expenses, dividends, and income summaryall have zero balances. The post-closing T-accounts will be transferred to thepost-closing trial balance, which is step 9 in the accountingcycle.

Financial Accounting

- The four-step method described above works well because it provides a clear audit trail.

- Check out this articletalking about the seminars on the accounting cycle and thispublic pre-closing trial balance presented by the PhilippinesDepartment of Health.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- In summary, the accountant resets thetemporary accounts to zero by transferring the balances topermanent accounts.

- The second entry requires expense accounts close to the Income Summary account.

Looking To Get Started?

- Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period.

- The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance.

- Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping.

- He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

- There are various journals for example cash journal, sales journal, purchase journal etc., which allow users to record transactions and find out what caused changes in the existing balances.

- This transaction increases your capital account and zeros out the income summary account.